New to Medicare

Turning 65

Congratulations on turning 65! We salute you for doing yourself a favor by taking the time to educate yourself about Medicare. We are deeply grateful for the chance to help you.

When Should I Apply for Medicare?

It is recommended for you to apply for Original Medicare (Part A and B) three months before you turn 65. For example, if you turn 65 in August, it’s advisable that you apply in May. This will be your Initial Enrollment Period. By applying three months before your 65th birthday, you will have peace of mind that you will have it ready to go as soon as your 65th birthday month starts.

If you are collecting, in most cases you will be automatically enrolled in Original Medicare (Parts A and B) without applying and should receive your Medicare card approximately 6-8 weeks before the first day of your 65th birthday month.

Remember, there is one more step that you need to do after receiving your Medicare card, which is deciding if you would like to stay on Original Medicare or enroll in Medicare Advantage Plan (Part C) or Medicare Supplement Plan.

How to Apply for Medicare?

There are several ways to apply for Original Medicare:

- Online via Social Security Administration, click here

- Over the telephone by calling Toll Free 1-800-772-1213

- Apply in person at your local Social Security Office

Turning 65 while still having an Employer or Union Coverage

If you are applying for Original Medicare and still working, it is essential to understand which insurance (Medicare or your employer’s group plan) will be your primary insurance and thus will pay for your bills first when you seek care.

If you get group health through a small employer (with less than 20 employees), it is highly recommended that you apply for both Part A and B as Medicare will be your primary, and your employer’s plan will be your secondary insurance. If you get the group health insurance through a large employer (with more than 20 employees), you may not need to apply for Part B until you plan on leaving your group health insurance. If you get the coverage from a union or other similar retiree plan, we strongly suggest checking with your group plan’s administrator to see how Medicare will work with your group plan before you make any changes.

It is also recommended to evaluate the benefits and costs between staying on the group health insurance versus leaving the group health insurance and joining the Medicare.

Older than 65 but ready to retire

If you are older than 65, have Medicare Part A, and leave the group health insurance soon, the best way to apply will be in person by visiting your local Social Security Office or over the telephone by calling Social Security at Toll Free 1-800-772-1213.

You will need to complete both Form CMS-40B (Application for Enrollment in Medicare Part B Medical Insurance) and Form CMS-L564 (Request for Employment Information). Form CMS-L564 shows that you had creditable coverage, therefore both you and previous employer will need to complete and sign this form, and it needs to be filled out completely to waive the late enrollment penalty. Both forms CMS-40B and CMS-L654 must be submitted together.

Frequently Asked Questions

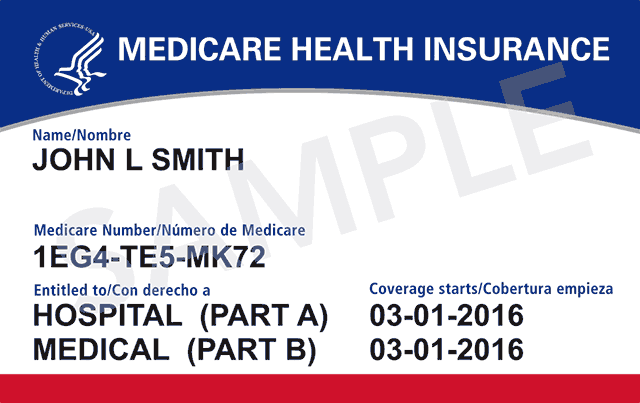

What is my Medicare claim number?

Medicare claim number which is also known as Medicare Beneficiary Identifier (MBI) is the number that Medicare uses to file your claims. MBI are numbers and upper-case letters that you may find on your Medicare card. If you enrolled in Medicare prior to 2018, you should have received a new Medicare card. The MBI used to be your social security number with a letter after it. Between April 2018 and April 2019 the CMS (Centers for Medicare & Medicare Services which is governmental agency that administers Medicare) mailed new Medicare cards which had a new MBI instead of your social security number to prevent identity theft and tax payer fraud.

Am I required to sign up for Medicare when turning 65?

No, you don’t have to. But keep in mind unless you have creditable insurance, for example an employer sponsored health coverage, you will incur a late enrollment penalty that sticks with you for life.

How old do you have to be to get Medicare?

Most people get Medicare at 65 years old. Anyone who has Amyotrophic Lateral Sclerosis (ALS) or End Stage Renal Disease (ESRD) qualifies at any age without having to wait. Those collecting Social Security Disability Income (SSDI) for at least 24 months can be eligible regardless of age.

Who is not eligible for Medicare?

Those who are not a US citizen or haven’t been a resident of the US for at least five years as well as those who are younger than 65 years old without disabilities. To learn more about Medicare Eligibility, click here.

Do I need to renew or reapply Medicare every year?

No, once you have Medicare, you do not need to reapply. Just need to make sure that you continue paying your Part B and/or Part A monthly premiums.

I’ve applied for Medicare, when can I enroll in a plan?

While you are waiting for Medicare to get processed and your Medicare card to arrive, you can start reviewing your options for Medicare insurance plans. For more detailed information of all Medicare enrollment periods, click here.

I’ve applied for Medicare, what’s next?

The Social Security Office representative may reach out to you for some verifications regarding proof of citizenship or legal residency, a birth certificate, and driver’s license. It usually takes around 4-6 weeks for your card to arrive after your application has been submitted and processed.

Once I apply and receive my Medicare card with Parts A and B, am I completely covered?

Even though it’s definitely something to cheer about, it is very important to remember that your Original Medicare (Part A and B) together still only cover 80% of your healthcare costs, and they both have deductibles and coinsurance. Put simply, your Original Medicare does not cover all of your healthcare costs by itself. Most people choose to add a Medicare Supplement plan, a prescription drug plan, or enroll in a Medicare Advantage plan to help cover the deductibles and coinsurance that Original Medicare does not.