Individual / Family Insurance

In California, you must be enrolled in a health plan all year round, otherwise if you go without health coverage, you will face a tax penalty.

You may enroll during Open Enrollment which happens in the Fall for the next calendar year coverage. Outside of Open Enrollment, you can only enroll in a health plan if you have a qualifying event, such as moving outside of your plan’s coverage area, turning 26, having a baby, getting married, having your MediCal terminated, or losing your group coverage.

These are things that you may want to consider when it comes to choosing your health insurance:

- Are the doctors or hospitals you prefer in the network of the health plan?

- Do you have any preference when it comes to the type of plan: HMO, PPO or EPO?

- Do you need regular access to care or just in case it is needed?

- Are there prescription drugs you take regularly?

There are three options available for Californians to get covered:

01. CoveredCA (On Exchange)

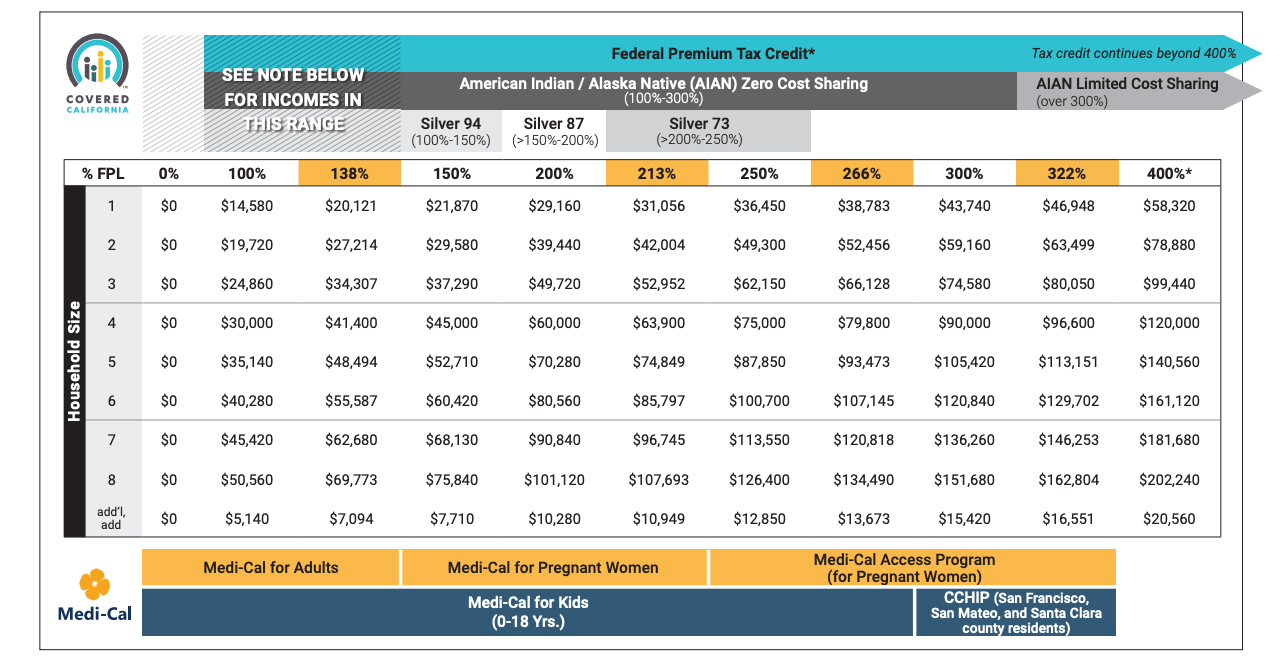

Covered California is California’s health exchange where individuals, families, and employers can obtain brand-name health insurance under the Patient Protection and Affordable Care Act, known as Obamacare . It is the only place to get federal premium assistance to help people buy affordable health insurance. Depending on your income, you may qualify for a discount on not only your monthly premiums but your out-of-pocket costs as well, or get free health insurance through California’s Medi-Cal program which is California’s version of the Federal Medicaid program.

To be eligible for premium assistance, you must:

- Meet the income requirement (annual household income between 100% and 400% of the Federal Poverty Level).

- Not offered affordable health insurance through an employer.

- Not be eligible for other health coverage, such as premium-free Medicare Part A or military coverage.

- Be a US citizen, a US national, or be lawfully present in the United States.

- File taxes for the year you will receive premium assistance.

- File taxes jointly if you are married.

Check the chart below to see if you meet the income requirement and give us a call or click here to schedule a phone appointment.

02. Health Insurance (Off Exchange)

If you do not qualify for discounted health insurance because of your income, you may purchase health insurance directly from the carrier which is also known as “off-exchange”. You may enroll directly with your choice of carriers by clicking the corresponding logos. For personal guidance please call us at (626) 244-8855 or schedule a FREE phone consultation by clicking here.

03. Dental and Vision Plans

There is no “Open Enrollment” period for dental and vision which means you can purchase it anytime. However there is a waiting period for certain dental services. Waiting period is a period of time you must wait after purchasing the policy before you can receive certain services. All health plans in California include pediatric dental and vision until the age of 19.

There are two types of dental insurance: PPO and HMO. Many dentists only accept PPOs. If your dentist doesn’t accept your PPO plan, you can still use it, however you will be charged out-of-network rates. In contrast, HMOs don’t provide coverage outside the plan’s network. Be sure to take into consideration the waiting period and the annual maximums when it comes to choosing your dental plan.

You may enroll directly with your choice of carriers by clicking the corresponding logos. For personal guidance please call us at (626) 244-8855 or schedule a FREE phone consultation by clicking here.

Frequently Asked Questions

When can I enroll in a health plan?

You can enroll in a health plan during Open Enrollment, which happens each Fall for the next calendar year. Outside the Open Enrollment period, you can only enroll in a health plan if you have a qualifying event such as getting married, losing group coverage, termination of MediCal, having a baby, etc. There is no “Open Enrollment” period for dental and vision plans which means you can purchase it anytime.

Does Covered California have an estate recovery program like MediCal?

No. The advance premium tax credit (the subsidy) either from the Federal or the State of California are reconciled on the individual’s income tax return. If you made much more money than you estimated, then you would have to repay some or all of the subsidy you received during the year.